Buying a car without a PPSR check or a car history report is no less than a gamble. To save yourself from enormous risk, get yourself a PPSR check. When you are buying a used car, you should know the complete background of the car before you make a payment and sign documents. Previously known as the REVS check, the PPSR check is quick and affordable. This check protects you from losing thousands or getting an asset owned by the lender.

Sometimes PPSR check isn’t enough because it displays only limited information; in that situation, you should opt for Check Vehicle History from Cars24. This is a comprehensive car history check report, which also includes a PPSR report, so no need to buy two separate reports; just one Check Vehicle History is enough to make a well-informed decision while buying a used car.

In this guide, we will learn about what a PPSR check is, why it matters and how it keeps buyers and sellers safe.

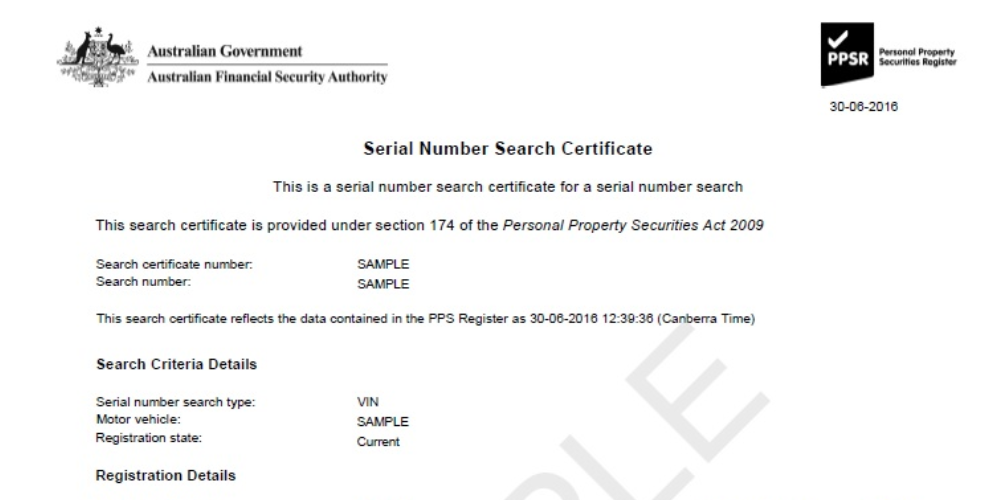

What is a PPSR check?

The Personal Property Securities Register (PPSR check) is Australia’s national online register of security interests. This is a public record showing whether an asset, such as a car, boat, machinery or any other personal property, is being used as collateral against a loan or other financial agreement.

The lender records a security interest on PPSR when someone takes out finance on an asset. This means if the borrower defaults, the lender can legally reclaim the asset, no matter who currently owns the asset. This is where PPSR checks become critical.

Why a PPSR Check Matters

If you want a full history of the car, you should get Check Vehicle History from Cars24. This is a comprehensive car history report that already includes a PPSR check report, so no need to get multiple reports. Our Check Vehicle History Report protects you from Encumbrance check, Written off check, Stolen check, Odometer comparison, Registration check, Vehicle Valuation, Market Demand and PPSR Report.

Here are the main reasons why every buyer, seller and business should have a PPSR check report:

- Protect yourself from buying something that’s still under finance

This is the most common and most costly situation. You might find a used car that looks great, drives well and has a convincing story. The seller may also seem a genuine Aussie, but there is money owing on the car, and you aren’t aware. In this case, you could lose the car even after paying in full.

A PPSR check reveals whether the car has an active loan or security interest against it. Without this check, you could unknowingly buy a car that a bank or finance company still legally owns. If the original borrower stops making repayments, the lender can repossess the car, leaving you out of pocket and without a vehicle. One small check prevents one very big headache.

- Confirm the seller is legitimate

The PPSR doesn’t just show financial interests, but also helps in validating whether the person selling the asset is the rightful owner of the car. For example, if a vehicle identification number (VIN number) doesn’t match the seller’s details or the record shows discrepancies, that can be seen as a red flag.

A PPSR report gives you confidence that the asset is not stolen, falsely advised or being sold by someone who isn’t the legal owner or authority to do so. In a world where scams are increasing, having a full report like Check Vehicle History from Cars24 can provide peace of mind. This report covers all the crucial areas needed to know before buying any used car.

- Verify accurate vehicle information

When purchasing a used car, you need more than visual and documented information. A PPSR check can reveal critical information such as:

- Encumbrance details

- Registration expiry

- Written off history

- Stolen status

- VIN check

This protects you from accidental misrepresentation and intentional fraud.If you want more than the PPSR report, then choose Check Vehicle History because this report includes:

- Encumbrance check

- Written off check

- Stolen check

- Odometer comparison

- Registration check

- Vehicle Valuation

- Market Demand

- PPSR Report

- Avoid hidden liabilities

Buying a car is more than just handing over cash. You inherit its history, which means any risks, defaults, debt, incidents and any other legal responsibility are tied to you. A PPSR check helps you avoid:

- Repossession risks

- Unpaid debts

- Insurance complications

- Legal disputes

- Unknown written off history

It’s essentially a financial background check, not an all-around inspection.

- Boost confidence in high-value transactions

Buying a family car is a high-value decision that requires greater protection and complete information; otherwise, there is a huge loss. A PPSR check allows you to negotiate confidently because you have verified information related to the financial background, and if you have a car history, then facts about the complete car history. That sense of certainty often leads to smoother sales, better pricing discussions and much less risk of being blindsided later.

Pro tip: Always get comprehensive car history check reports in high-value purchases.

- Protect your assets

As an owner, the PPSR is more than a tool; it’s a layer of security. You can use PPSR checks to verify equipment before purchasing, confirm that assets are unencumbered before accepting them as collateral, ensure leased or financed items are properly recorded, protect against insolvency-related losses and reduce exposure to risky transactions.

How to do a PPSR Check?

The process is straightforward:

- You enter the car details

- The register will check information

- Make a payment and download the report

Tip: Always visit the official website only.

What Happens If You Don’t Do a PPSR Check?

Skipping a PPSR check may seem harmless, but there are some consequences. Here are the most common consequences faced:

- Repossession: You will lose the car as the lender can take back the car even if you have paid the amount in full.

- Financial loss: You have no legal protection to recover your loss in case of repossession.

- Unexpected repairs: Since you don’t have a car history report, you can start discovering issues after a few days/months post-purchase

- Insurance issues: Insurers may decline coverage if the car has a questionable history.

It is always better to get a Cars24 Check Vehicle History report to ensure that you get a full background of the car and there aren’t any hidden issues or surprises post payment.

Final Thought

A PPSR check is one of the simplest ways to save yourself from financial burden. This ensures the asset you are buying is free from debt, legally owned and accurately represented.

Comments

New Comment