Many of you may either overestimate the costs of EV ownership and walk away, or underestimate them and get a nasty surprise later. Between big upfront prices, charging setups, and battery fears, EV ownership costs estimation can feel confusing.

Is it really going to be more cost-effective over time than buying a petrol or diesel equivalent? Is it the right time to switch to electric mobility? Is the range anxiety valid? These are just some of the doubts and questions that come up when deciding to buy an EV.

We’ve laid out a nearly accurate cost of owning an EV in Australia, but remember that this is an evolving segment with pricing variables such as state-wise taxes, electricity rates and breakthroughs in battery technology.

All the costs involved in owning an EV in Australia

We have considered the cost range for different EV-related expenses so that you can calculate the EV costs for a specific car model, according to your unique needs and situation.

| Cost name | Estimated cost range |

|---|---|

| Purchase price | $25,000 – $180,000+ |

| EV accessories and protection | $1,500 – $3,500+ |

| Electric car insurance | $1,800 – $3,800 per year |

| Charging expenses | Up to $1,600 per year |

| Servicing and maintenance | $400 – $1,200 per year |

| Home charger infrastructure | $1,550 – $5,500 |

| Battery replacement | $12,000 – $30,000 |

| Accident repairs | $800 – $15,000 |

| Car loan repayment | $700 – $1,300 per month |

| Make-good costs when reselling | $1,750 – $3,000 |

1. EV purchase price

Est. total expense range: $25,000 – $180,000 or more (depending on performance, brand, and state’s specific taxes).

Entry-level EV models (like the BYD Atto 1 or MG4) are priced at approximately $23,990 to $45,000 driveaway. Mid-range EV models are priced from $45,000 to $90,000, while premium luxury EVs range from $90,000 to over $200,000.

The government’s car taxes or stamp duty also vary by state. While some (like the ACT) offer full exemptions for new EVs, most states charge roughly 3% to 6% of the purchase price. For a $50,000 car, this is approximately $1,500 – $3,000.

Initial registration and plates generally cost $700 – $1,200. Some states (like Victoria) offer a small annual discount (approx. $100) for zero-emission vehicles (ZEVs).

For the 2025–26 financial year, the luxury car tax (LCT) threshold for electric cars is $91,387. If your car costs more than this, you pay a 33% tax on every dollar above the threshold. Most EVs below the LCT threshold are exempt from the standard 5% customs duty.

Most direct state-based cash rebates (like those in NSW, VIC, and QLD) have ended. The most significant saving is the Fringe Benefits Tax (FBT) exemption for EVs priced below the LCT threshold when purchased through a novated lease. This can save thousands in pre-tax salary per year.

2. Accessories and protection for the EV

Est. total expense range: $1,500 – $3,500+ for protection and accessory setup.

The list of accessories for EVs and their cost can seem endless. Like the petrol cars, the real cost for these accessories depends on your needs and choice. Here are some common add-ons, accessories, and protective equipment with their costs.

Paint protection (ceramic coating) ranges from $900 to $2,000, depending on the car size, window tinting between $400 and $600, and interior protection for seats and carpets often starts around $395. Many EV brands bundle these for the new cars, and you often get a discount on these. Portable charging cables (often not included), cable organisers, floor mats, and boot liners can add $500 – $1,000 more.

3. Electric car insurance

Est. total expense range: $1,800 – $3,800 per year

Since EVs use complicated and expensive technology, insurance can be slightly more expensive than equivalent combustion engine models. Parts (like sensors in bumpers) and specialised battery casings are more expensive to repair after an accident. Insurers also worry about “total losses,” where a small dent in the battery frame results in the whole car being written off.

The cost of an annual premium (comprehensive) has a range of $1,800 – $3,500. Some insurers also add a technology loading fee because there are fewer certified repairers in regional Australia. Excess is often set higher, around $800 – $1,200, to keep the annual premium down.

4. Charging expenses

Est. total expense range: Up to $1,600 per year (Most owners spend about $500)

This is where you make your money back on those higher up-front costs. Home charging is like buying wholesale, while highway fast-charging is like buying from a convenience store. Home charging is the most affordable, but your range of travel is limited, while fast-chargers charge a premium for the convenience of being available far from home.

Here are the estimated costs of charging an EV (based on 13,000km/year):

Home charging (off-peak) costs about $350 – $550 per year, and if you charge at night on an “EV Plan” (approx. $0.15/kWh), it is incredibly cheap. Solar charging makes EV charging free. If you charge during the day using your own roof panels, you only pay the lost feed-in tariff (approx. 5c/kWh). Public fast charging is expensive and costs about $1,100 – $1,600 per year.

Depending on the range and powertrain of your EV, you can easily save thousands of dollars in running costs compared to an equivalent combustion engine model.

5. Servicing and maintenance

Est. total expense range: $400 – $1,200 per year (averaged out over the first 5 years).

EVs are mechanically simpler with a lot fewer moving components, but they aren’t maintenance-free. An annual logbook service costs around $200 – $450, which usually covers a safety check, wiper blades, and a software update.

The additional weight of an EV usually means tyres have a shorter lifespan. Tyre replacement can hit you with $1,200 – $2,000 more, every 2–3 years, because EVs are heavy and fast, they eat tyres. Add $0 – $300 more for the brake pads, which can last well over 100,000km (thanks to regenerative braking).

6. Home charger infrastructure

Est. total expense range: $1,550 – $5,500 (depending on your home’s wiring)

A standard wall socket is usually painfully slow for topping up the massive battery of an electric car, and a wallbox (Level 2 charger) charges your electric car about 3 to 5 times faster.

The hardware box costs around $750 – $1,500, depending on features like “smart charging” (to use your solar panels) or Wi-Fi connectivity. A standard installation will remove an additional $800 – $1,500 from your wallet.

If your home is quite old, your electrical board might not be able to handle the extra load and will need a full modern upgrade. A switchboard upgrade can cost $1,500 – $2,500.

7. Battery replacement

Est. total expense range: $12,000 – $30,000

Many batteries are lasting much longer than expected, but if the battery fails, it is the single most expensive repair possible for your electric car. At this time, most owners don’t pay this because of the 8-year/160,000km warranty. Here are the specific cost numbers for EV battery replacement:

- Small EV (e.g., BYD Atto 1): $10,000 – $15,000

- Mid-size EV (e.g., Tesla Model 3 / Hyundai Ioniq 5): $15,000 – $22,000

- High-end luxury (e.g., Audi e-tron / Porsche Taycan): $25,000 – $40,000+

8. Accident repairs

Est. total expense range: $800 – $1,200 (if insured) or $3,000 – $15,000 (non-insured minor-to-moderate hits)

Repairing an EV is currently more expensive than a petrol car due to specialised labour and component sensitivity. Furthermore, many Aussie insurers will “write off” the car entirely when the metal casing around the battery cannot be easily repaired safely.

Minor panel work (dent or scratch) can cost you about $1,500 – $3,500. Front-end sensor/radar replacement can cost you $3,000 – $6,000 more. For bottom damage, a battery casing inspection can cost an additional $800 – $1,500.

9. Car loan repayment

Est. total expense range: $700 – $1,300 per month (depending on your tax bracket and loan type).

If you buy an EV through your job (Novated Lease), it is significantly cheaper than a standard bank loan because of the Fringe Benefits Tax (FBT) Exemption. If you buy privately, many Australian banks now offer “Green Loans” with lower interest rates for electric cars. Here are the specific cost numbers (based on a $60,000 EV over 5 years):

- Establishment fees: $200 – $600 for the upfront fee to set up the loan.

- Standard car loan (approx. 7–9% interest): Monthly payments are roughly $1,100 – $1,300. Over the life of the loan, you pay $12,000 – $16,000 in interest.

- Green car loan (approx. 5–6% interest): Monthly payments are roughly $1,050 – $1,150. The interest total is roughly $8,000 – $10,000.

- Novated Lease (pre-tax): Because payments come out of your salary before tax, the real hit to your take-home pay might only be $700 – $900 per month. This includes your charging, insurance, and rego.

10. Make-good costs when reselling

Est. total expense range: $1,750 – $3,000 (varies with the service, product, and your EV)

This is the “sprucing up” you do to get the best price when you sell your car. Because many EV buyers are tech-savvy, they look for specific things that a petrol car buyer might ignore.

Buyers may demand an independent “State of Health” battery report to prove the battery is still good, and it may range from $150 – $300. EVs wear tyres faster, and a fresh set of EV-specific tyres can cost $1,200 – $1,800 when you need to replace them.

Standard paint and interior detailing to remove cabin rattles or minor scuffs may cost around $400 – $800. Moreover, software reset and owner unlinking may cost up to an additional $100.

5-year total cost of ownership for an EV in Australia

We have considered an EV ownership horizon of five years from new and an annual distance of 13,000 km without any battery replacement. The total cost of ownership (TCO) of 5 years is calculated as per the cost values mentioned previously, and a Green loan case at 5.5% APR for five years. The charging cost is estimated at $800 per year, including a mix of AC and DC charging uses.

| EV category | EV buying price (drive-away) | Total cost of ownership in 5 years |

|---|---|---|

| Budget EV | $34,500 | Cash purchase: $68,335; Financed: $73,471 |

| Mid-range EV | $60,000 | Cash purchase: $94,600; Financed: $103,418 |

| Mid-luxury EV | $100,000 | Cash purchase: $138,642; Financed: $153,362 |

| Luxury EV | $150,000 | Cash purchase: $206,642; Financed: $228,722 |

The calculation is done with the midpoint values of the different cost category ranges mentioned previously. The luxury car tax (LCT) is considered 33% for EVs above the $91,387 threshold. All the costs and incentives associated with EV ownership are described in the next section.

Typical costs of owning an EV in Australia per month

For a mid-range EV bought at $60,000 drive-away, here are the monthly costs for the EV owner in a 5-year ownership period:

- Cash purchase (excluding loan): $583/month

- Financed (loan case): $1,730/month

EV cost per 100 km in Australia

For a mid-range EV bought at $60,000 drive-away, here are the running costs (standing + operating costs) per 100 km for the EV owner in a 5-year ownership period:

- Charging cost per 100 km: $6.15/100 km

- Running cost per 100 km (excluding loan): $53.85/100 km

- Running cost per 100 km (loan case): $159.72/100 km

Federal and state incentives for owning an EV

Instead of giving direct cash “rebates”, the state governments offer tax concessions, registration discounts, or energy loans. You mainly get these three key benefits for buying an EV:

1. Fringe benefits tax (FBT) exemption: The ATO charges a big 47% tax to prevent employers from dodging income tax if they give you a car for personal use. For eligible EVs, this tax is deleted. The benefit for you is a lower taxable income; you pay for the electric car using a novated lease.

2. Higher luxury car tax (LCT) threshold: The government has a “luxury limit” that cars can’t cross without being hit by an extra sales tax. They set this line higher for electric cars to encourage people to buy them. Currently, if an EV costs up to $91,387, you pay no LCT, vs $80,567 for other vehicles.

3. Import tariff exemption: The government usually charges a 5% import duty when a car arrives in the country. For EVs below a certain price point, they simply got rid of this 5% tax. Many sellers usually pass on this discount to you.

4. State-government programs: They have specific names for the electric vehicle-based incentives. For instance, “Stamp duty exemption” and “Registration concession” in several states, “Sustainable Household Scheme” in the ACT, and “Energy Saver Loan” in Tasmania

MORE: Find out the current market value of your EV

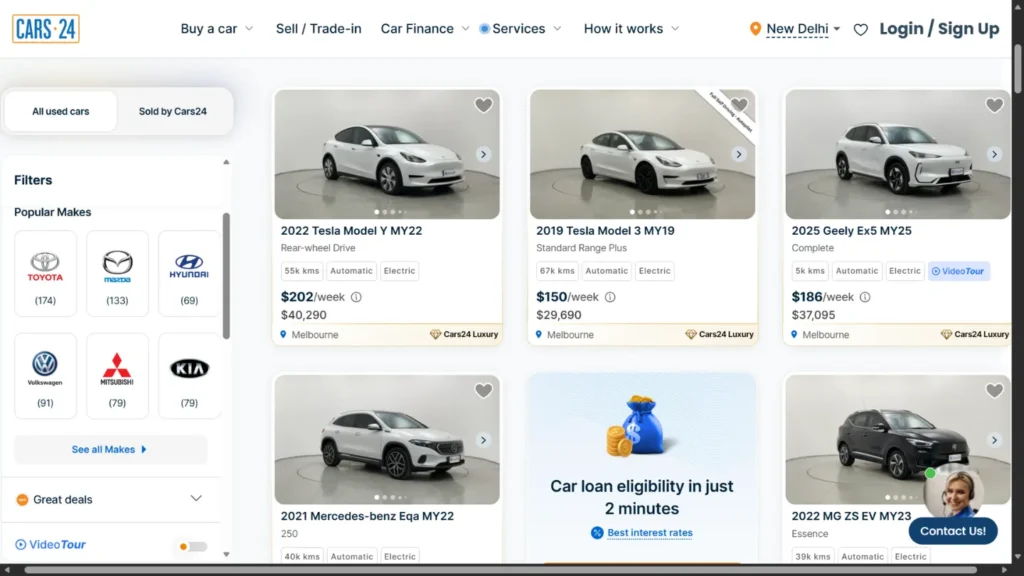

Is it worth buying a second-hand electric car?

EVs currently depreciate faster than petrol and diesel cars. For second-hand EV buyers, this could be a massive advantage if you know how to find a great deal. The used electric cars will have slower charging speeds or less range than the brand-new ones, but if it fits your needs, then why not have it, right? You can use these three tests to decide if a specific used EV is right for you:

1. The warranty gap test: Most EV manufacturers provide an 8-year/160,000km battery warranty in Australia. Only buy if the car has at least 2–3 years of battery warranty remaining. This protects you from the rare but expensive risk of a full battery failure. See the car’s history online to find out its remaining warranty.

2. The 80% health rule: Request a State of Health (SoH) certificate from the seller. Aim for a score of 85% or higher battery health. If it’s below 80%, the range will be noticeably shorter, and the battery may be nearing its second life phase.

3. The plug & play check: The aim is to find an electric car that uses the CCS2 charging port, which is standard on almost all modern Australian public chargers.

If you drive less than 100km a day and can charge at home, a 3-year-old EV could be a great value-for-money transport in Australia.

Conclusion

Based on our analysis above, you can see that the costs of owning an electric car in Australia are not that cheap, and most are predictable. The big expense is the upfront price, finance structure, and a few EV-specific risks like battery replacement and accident repairs. A novated lease can make an EV significantly lighter on your wallet than a traditional loan.

A used EV, bought wisely with battery health and warranty in mind, can also be one of the best value moves. Think of an EV as a long-term commitment, do the maths, understand the incentives, and choose a car that fits your daily driving needs and don’t stress over the potential long road trip that you haven’t made in years.

FAQs

- What is the electric car vs petrol car cost per km?

A standard small SUV (using about 8L/100km) costs roughly 16 to 18 cents per km, assuming petrol is around $2.10/L. An EVcosts about 3 to 4 cents per km if you charge at home on a standard off-peak rate.

- What is the 80-20 rule for electric cars?

The 80-20 charging rule helps your EV battery’s health and longevity. For daily driving, you should set your car’s charge limit to 80% and not let it drain under 20% charge for long periods. You can charge to 100% occasionally for a long trip or once a week for LFP batteries.

- How much does it cost to replace the battery in an EV?

In 2026, most EVs on the road are still under their 8-year/160,000km manufacturer warranty. However, depending on the size of the battery and the brand, a full replacement costs between $12,000 and $25,000.

- Are EV charging stations free in Australia?

Most EV charging is not free anymore, but there is still some free power. Many Westfield malls and local council car parks offer free “Destination” charging. Some NRMA members still get discounts or free access to specific chargers. Many regional tourist stays offer free charging to guests.

- What are the hidden costs of owning an EV in Australia?

There are mainly two hidden or not commonly considered EV cost factors:

1) Faster tyre replacement, as the electric cars are usually heavy and have instant torque, both factors increase tyre wear.

2) Technology obsolescence (depreciation) is fast, which makes the EV harder to sell for a high price.

Comments

New Comment